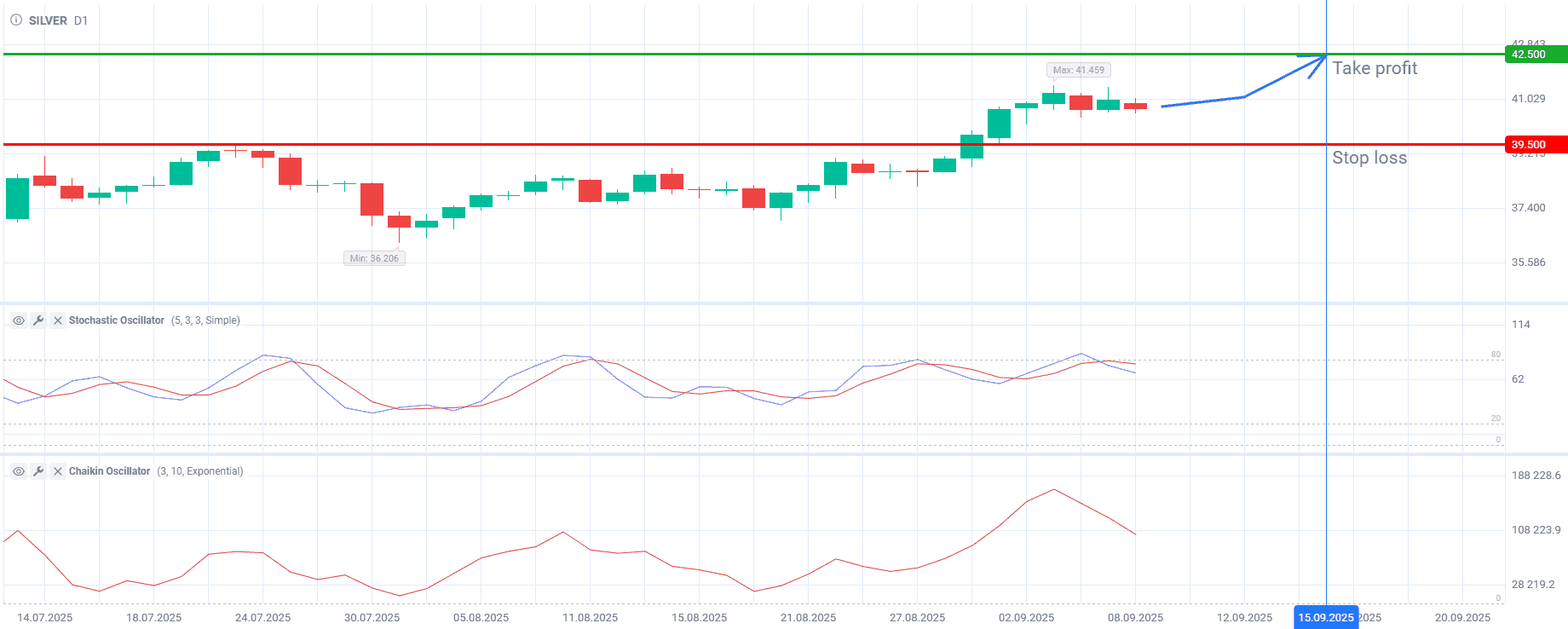

Silver has been correcting since hitting a local high of $41.459 on September 3. During today’s early trading, the precious metal continued its decline, dropping to $40.690 and signaling seller dominance.

Technical indicators confirm weaker upward momentum. The Stochastic Oscillator (5, 3, 3, Simple) entered overbought territory at the beginning of the month and then reversed downward. The %K and %D lines are currently located in the neutral zone at 67 and 75, respectively. However, they demonstrate a bearish crossover, suggesting increasing pressure from sellers.

The Chaikin Oscillator (3, 10, Exponential) paints the same technical picture. The indicator is now plummeting from the peak of $41.459. Its negative dynamics are outpacing the price drop, which is considered a classic sign of capital outflow and reduced interest from buyers. This fact confirms that the current pullback is not just technical but fundamental in terms of market volume.

The pressure is further exacerbated by underlying concerns regarding industrial demand. Despite the potential interest rate cut in the United States, which would be favorable for precious metals, uncertainty over import tariffs and vague conditions in the labor market cast a shadow on silver prospects. These factors have a negative impact on business activity in the country and tarnish investment appetite, thereby preventing metal prices from growing.

Although a bearish scenario is playing out in the short term, silver remains within its uptrend due to the Fed’s intention to ease monetary policy in September. The key support level at $39.50 is still out of reach. Meanwhile, the current downward move looks like a healthy correction after a recent rally, providing investors with an opportunity to open favorable buy positions. Silver is highly likely to consolidate ahead of the Fed meeting on September 17–18, 2025.

Take into account the following trading plan:

Buy during the correction. Take profit: $42.50. Stop loss: $39.50.

The forecast remains valid from September 8 to September 15, 2025.