Unlike most developed economies, Japan is now following the opposite monetary policy path. While other countries are considering cutting interest rates, the Asian nation is moving towards tightening. Such conditions provide a good opportunity for carry traders, who profit from the divergence in global central banks’ actions.

The Japanese yen has long been positioned to strengthen against the US dollar and other major currencies, both fundamentally and technically. This week, a statement by Taro Kono, Liberal Democratic Party lawmaker, former Minister for Digital Transformation, and candidate for the post of Japan’s Prime Minister, served as another trigger for discussion about upcoming monetary tightening. He argued that the Bank of Japan (BoJ) should increase borrowing costs to support the yen and curb persistent inflation. According to the official, if the regulator postpones a rate hike, consumer prices will keep rising, along with imported goods. The Liberal Democratic Party is poised to hold elections to choose a successor to Prime Minister Shigeru Ishiba, who recently resigned. Kono’s comments came several days after Ishiba’s decision to step down raised questions about the regulator’s economic outlook. Some analysts cited the likelihood of a delayed rate hike by the BoJ, while others expressed concern about potential fiscal stimulus.

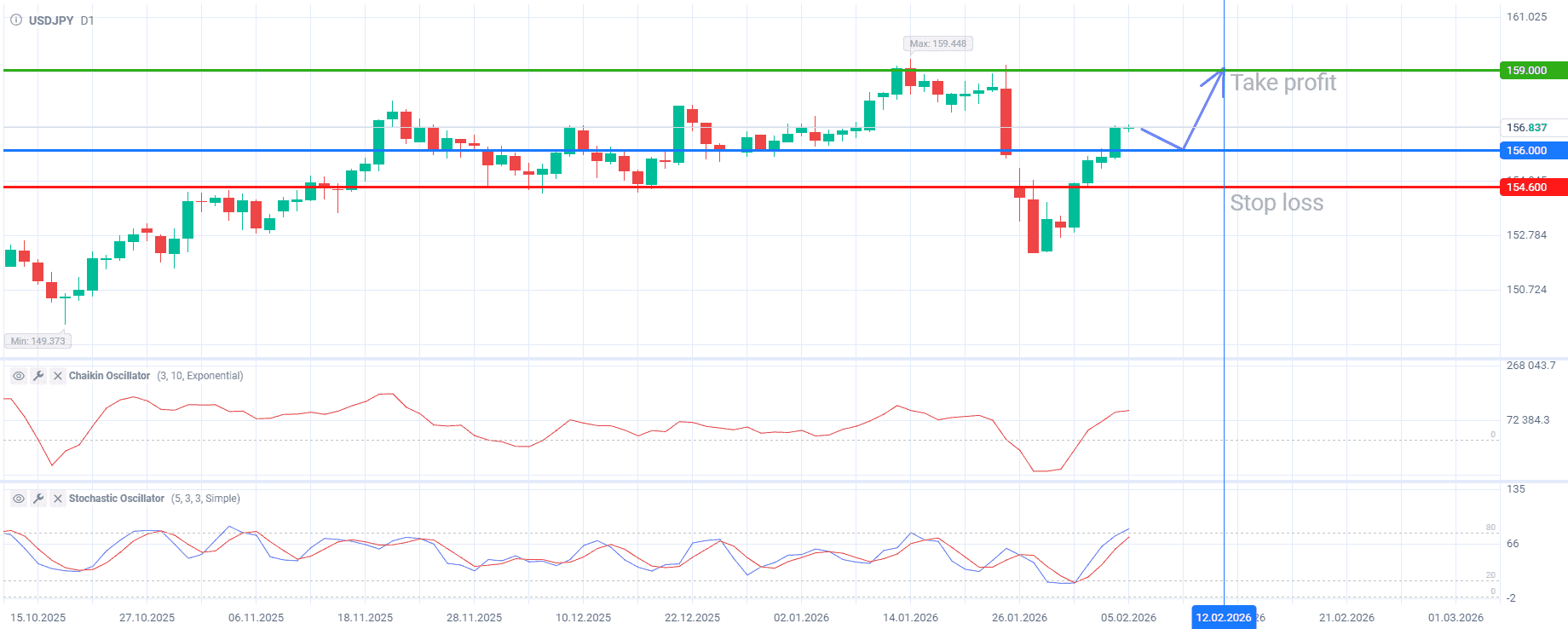

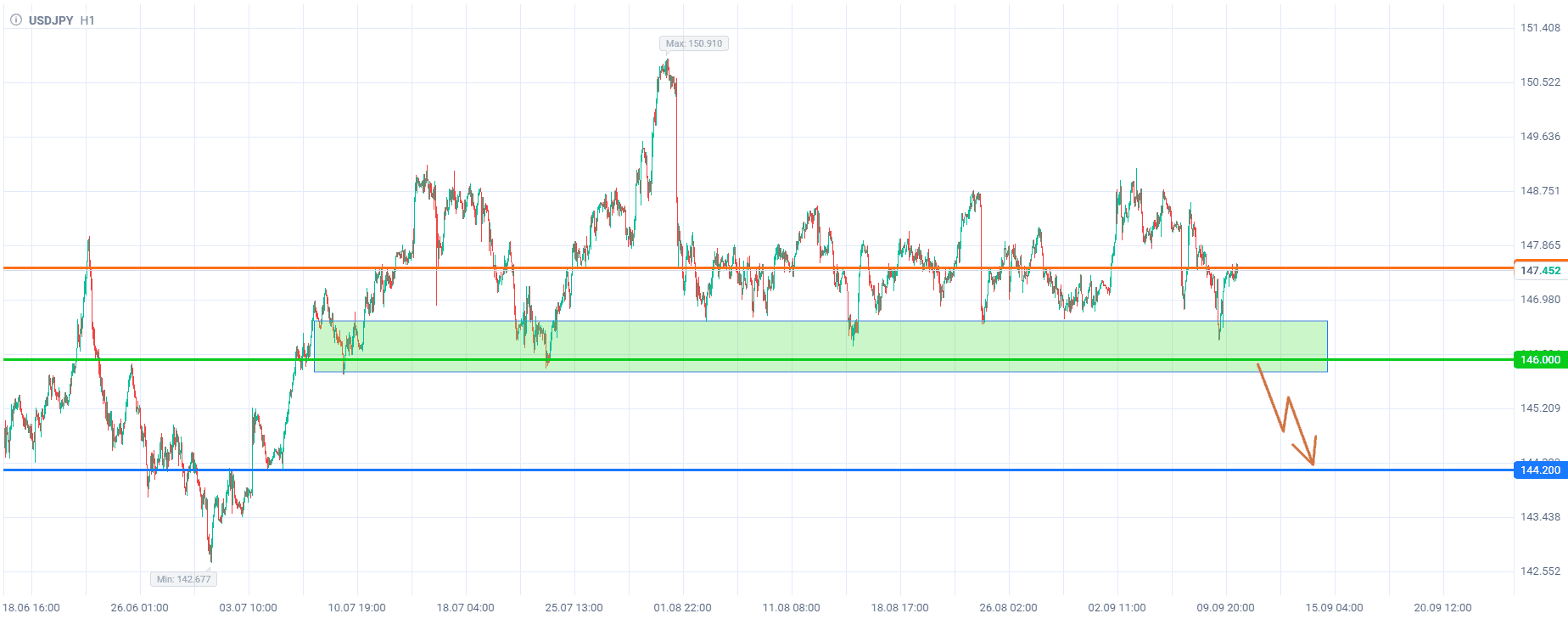

The overall recommendation is to sell USDJPY from the 146.00 level. Profits should be taken at 144.20. Stop Loss could be set at 147.50.

The volume of the open position should be calculated so that the potential loss (protected by a Stop Loss order) does not exceed 1% of your deposit. If your account balance does not allow opening a position of this size, it is better to avoid entering the market on this signal and wait for other trade options that meet low-risk criteria.

Source: