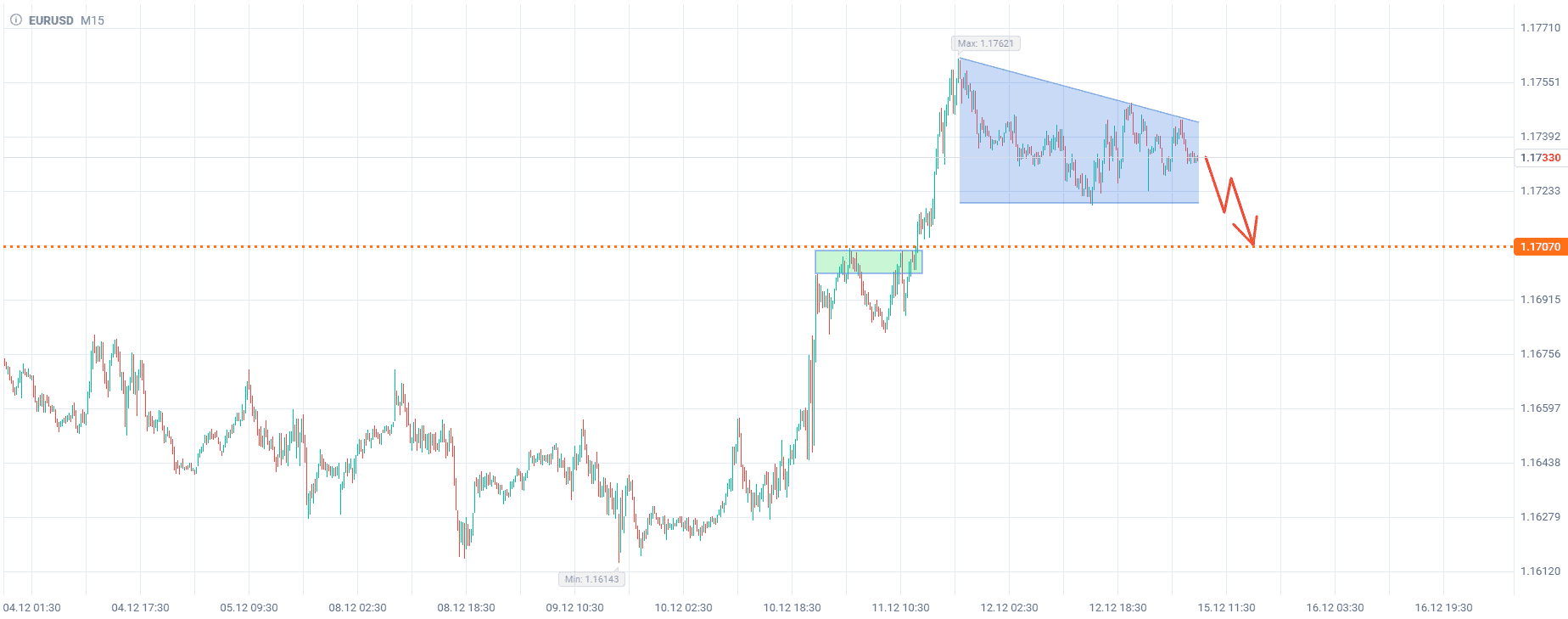

The dovish outcome of last week’s Federal Reserve (Fed) meeting fueled a few short-lived rallies in EURUSD. The currency pair is now entering a correction, and a bearish wedge is forming on the chart. However, this pattern has not been fully shaped yet, with a potential baseline between 1.1720 and 1.1750.

Breaking through the bottom of this figure is likely to accelerate EURUSD’s decline toward 1.17070, a support level marked by previous highs. It may act as a magnet for the pair.

Such a downward move could be triggered by a flurry of delayed economic releases following the recent US government shutdown. Key data are set to be published in the near future, providing more clarity on the state of the US economy. Nonfarm Payrolls (NFP) readings for November are due on Tuesday, December 16, 2025.

After that, on Thursday, December 18, 2025, the US Consumer Price Index (CPI) will be released. If inflation figures are unexpectedly high, as could be the case with the employment report, the dollar could get a boost, intensifying the EURUSD pair’s decline.

The overall recommendation is to sell EURUSD. Profits should be taken at the level of 1.17070. Stop Loss could be set at 1.17710.

The volume of the open position should be calculated so that the potential loss (protected by a Stop Loss order) does not exceed 1% of your deposit. If your account balance does not allow opening a position of this size, it is better to avoid entering the market on this signal and wait for other trade options that meet low-risk criteria.