NVIDIA (NVDA) stock ended the February 3 session with a 2.8% plunge, consolidating near the psychologically important $180 level after a long period of heightened volatility and a few corrective pullbacks from January highs. The current market environment makes investors tiptoe around.

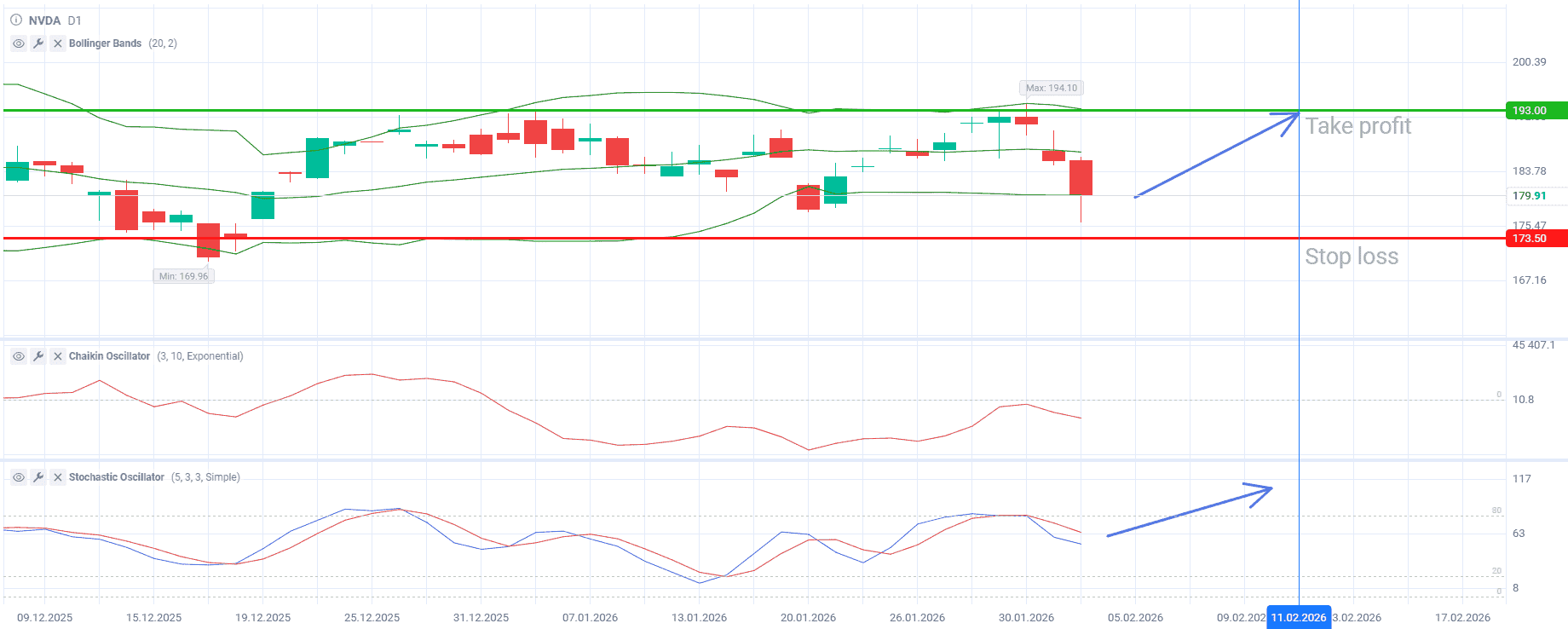

From a technical standpoint, the price closed at $179.91 yesterday—slightly beneath the lower Bollinger Band at $179.96, close to the the 20-day simple moving average (SMA20) at $186.52. This is a telltale sign of oversold conditions that increases the chance for a near-term rebound. Narrowing Bollinger Bands indicate reduced volatility, which often precedes a new directional impulse.

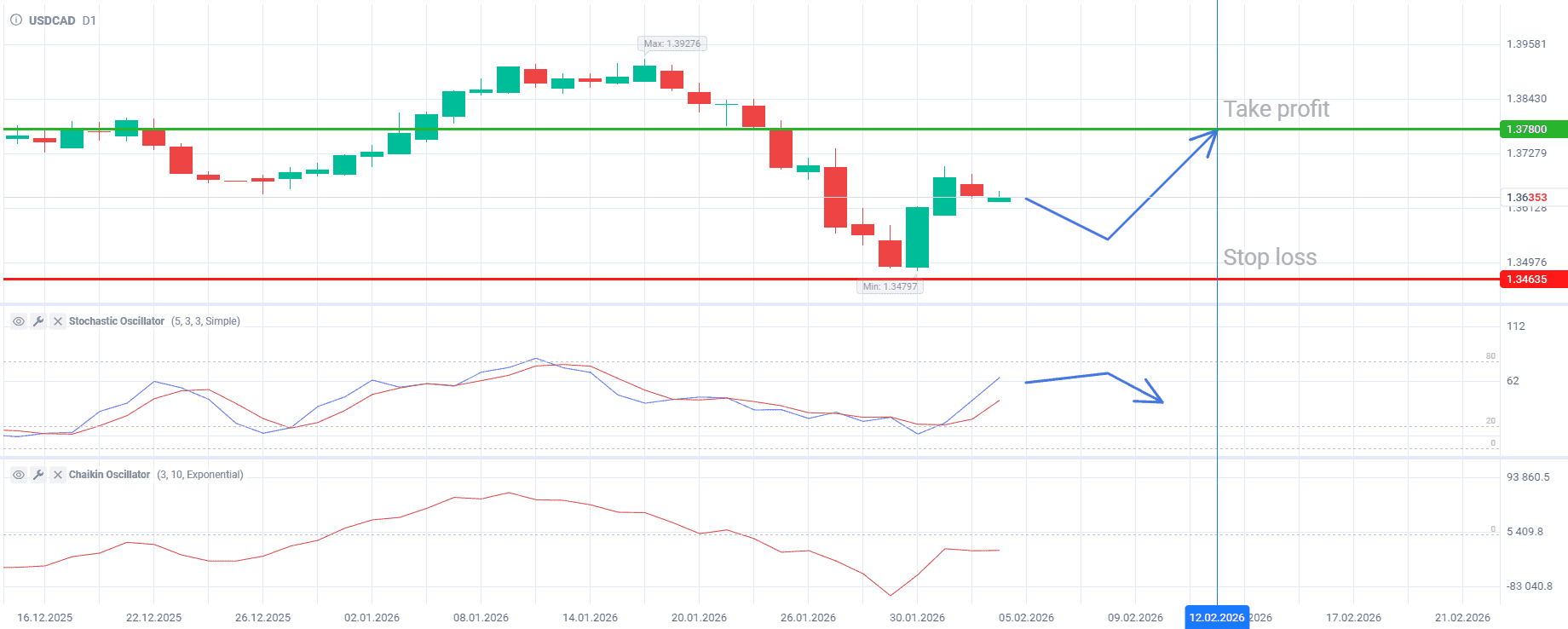

The Stochastic Oscillator remains in neutral territory, with a slight bearish bias. The %K line (51) sits below the %D one (62), signaling lingering downward pressure but without reaching oversold extremes. Thus, the price has enough room to move in any direction.

Meanwhile, the Chaikin Indicator keeps exploring the negative zone. However, it has recently found firmer ground after a steep decline in January, suggesting that selling pressure may be abating. Breaching the zero line could confirm that major market players are back in the game.

As for the fundamental picture, it isn’t so clear. On the positive side, NVIDIA’s planned $20 billion investment in OpenAI proves its strategic importance in the artificial intelligence (AI) industry. The expected launch of Blackwell chip-based models in March could also serve as a significant growth catalyst.

On the flip side, several concerns weigh on the stock. Yesterday’s selloff was triggered by persistent fears that the AI sector is overvalued and facing intensifying competition. Moreover, geopolitical risks are still on the agenda. NVIDIA’s exports of H200 chips to China have been on hold for over two months since US President Donald Trump approved these deliveries. This creates revenue uncertainty in the company’s second-largest market.

Consider the trading plan presented below:

Buy NVDA between $180 and $181, with Take profit at $193 and Stop loss at $173.50.

This forecast remains valid from February 4 to February 11.