Gold opened at $3,590.00 per ounce today. Market dynamics are being influenced by an unexpectedly weak US employment report for August, which reinforced trader projections of an imminent interest rate cut by the Federal Reserve (Fed). According to these forecasts, the central bank will ease monetary policy as early as September 17.

Market players with almost a 100% probability expect a 25-basis-point rate cut at the next Fed meeting. They also do not exclude the chance of a more aggressive 50-basis-point move by the regulator. Lower rates reduce the opportunity cost of holding non-yielding gold and put additional pressure on the dollar, making the precious metal more affordable. The weak labor market report on the labor market also raises concerns over the US economic outlook, increasing gold’s attractiveness as a safe-haven asset.

Steady demand from central banks is another factor supporting the metal’s appreciation, along with other macroeconomic factors. The People’s Bank of China increased its gold reserves in August for the tenth consecutive month, adhering to its policy of diversifying away from the dollar. The fact that global regulatory bullion stocks exceeded those of US Treasuries by value for the first time since 1996 underscores a structural shift in asset preferences toward the metal.

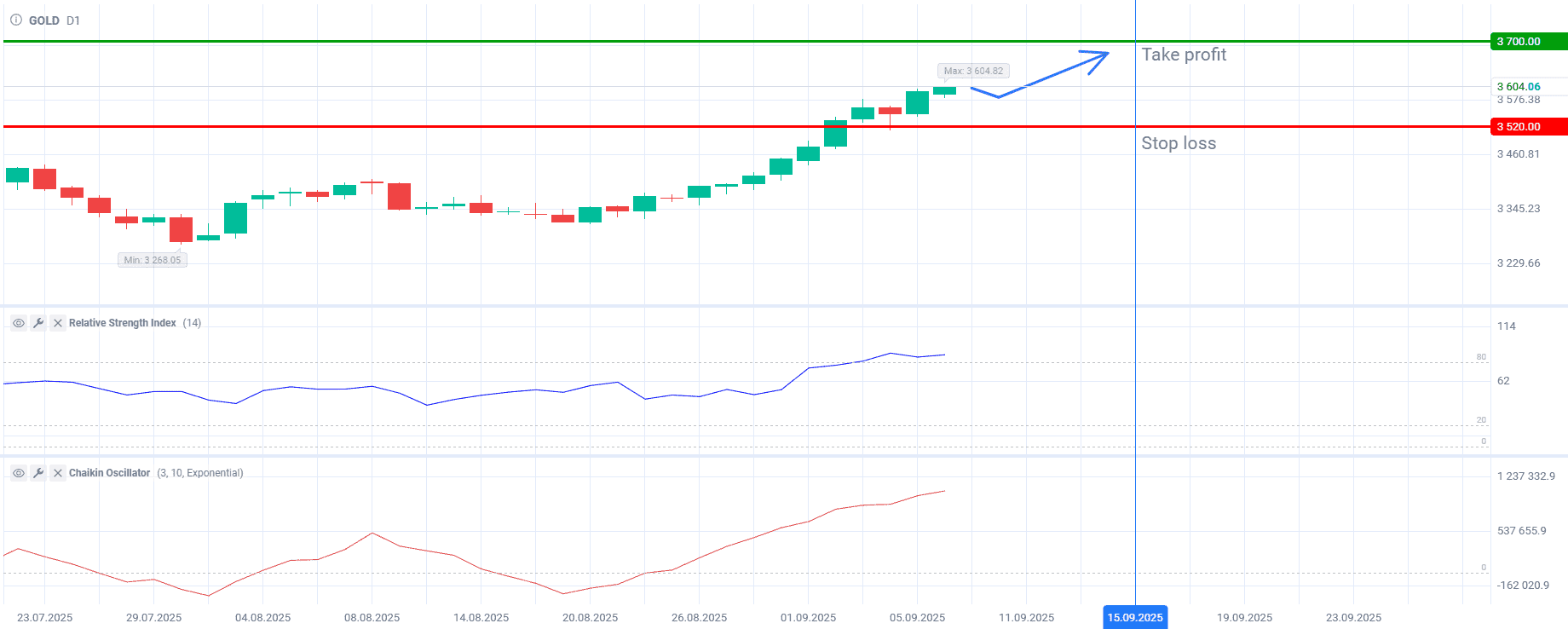

From a technical perspective, the gold market is in a strong uptrend on the daily timeframe, with the price forming a new high above $3,600. The Chaikin Oscillator is in positive territory, indicating buyer dominance and confirming the strength of the current upside. However, the RSI indicator (14) is at 86, suggesting a high degree of buying activity and potentially overbought conditions. In the short term, gold may enter a correction. If support holds, the upward trend is likely to resume.

Consider the following trading option:

Buy gold when the price corrects toward $3,520.00. Take profit should be set at $3,700. Stop Loss could be placed below $3,520.00.

The forecast remains relevant from September 8 to September 15, 2025.