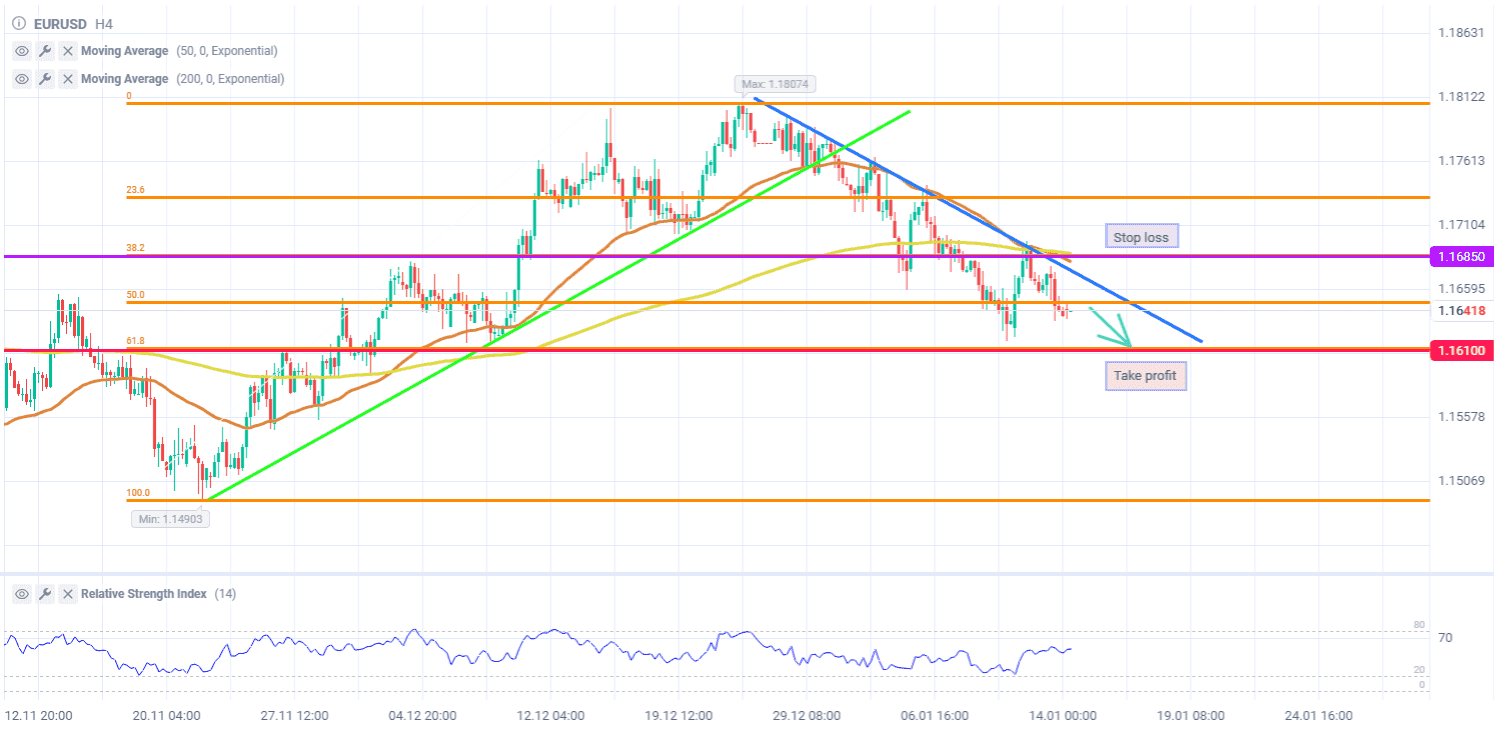

After reaching a local high slightly above 1.18 in late December, the EURUSD currency pair reversed and has since moved within a downtrend. At the start of this week, bulls attempted to seize the initiative, but the trendline held firm, proving to be strong resistance. The price is now returning to recent levels, with a test of monthly lows likely to follow. Bears are set to target the 61.8% Fibonacci retracement (1.161), measured from the November-December advance.

Monday’s rebound helped the Relative Strength Index (RSI) to move away from oversold territory on the 4-hour timeframe, preventing EURUSD from a deeper decline. In addition, a death cross pattern is visible on the chart, with the 50-day moving average dipping below the 200-day one. This factor may intensify selling pressure, especially if bulls try to breach the current downtrend once again. Under these circumstances, it is better to close short positions upon reaching the 1.161 level or if quotes consolidate above 1.1685.

Yesterday’s US inflation report for December came in as expected. Consumer prices were unchanged, leaving the Federal Reserve (Fed) with no choice but to stick to current interest rates. There is almost no doubt that the regulator will keep borrowing costs unchanged at its next meeting on January 28. The central bank is unlikely to ease monetary policy before June—coinciding with the expected resignation of Chairman Jerome Powell.

Meanwhile, former Fed heads, other central bank governors, and top executives from major companies have voiced their support for Powell amid a US Department of Justice investigation into him. Experts surveyed by Reuters agree that formal charges against the current Chair would severely undermine investor confidence in the US financial system. Even Donald Trump’s loyal followers have publicly cautioned against such a move. Hence, the dollar may soon be relieved of constant pressure.

Try out the trading strategy presented down below:

Sell EURUSD at the current price. Place a Take profit order at 1.161. Set Stop loss at 1.1685.