On September 11, 2025, the ETHUSD pair opened at $4,329.53. Morning trades showed its growth to $4,400, driven by the publication of weak US macroeconomic data. The Producer Price Index (PPI) experienced a sudden drop in August, prompting market expectations of an imminent interest rate cut by the Federal Reserve (Fed). This created a big push for risky assets, including Ethereum.

The fundamental picture for the token is looking fantastic. Major corporate entities, like BitMine, persist in their vigorous acquisition of ETH, resulting in a systematic liquidity shortfall within the market. Japanese tax reforms are paving the way for even more capital inflows coming from Asian investors. These changes include the introduction of a 20% duty on profits from crypto assets by 2026.

Additional support is being generated by rising institutional involvement. Approved spot ETFs consistently draw in investments, and the expansion of the real-world asset sector boosts the functionality of the Ethereum network. With over 56% of the total ETH supply staked and taken out of circulation, the potential for sell-offs remains limited, while buying pressure intensifies.

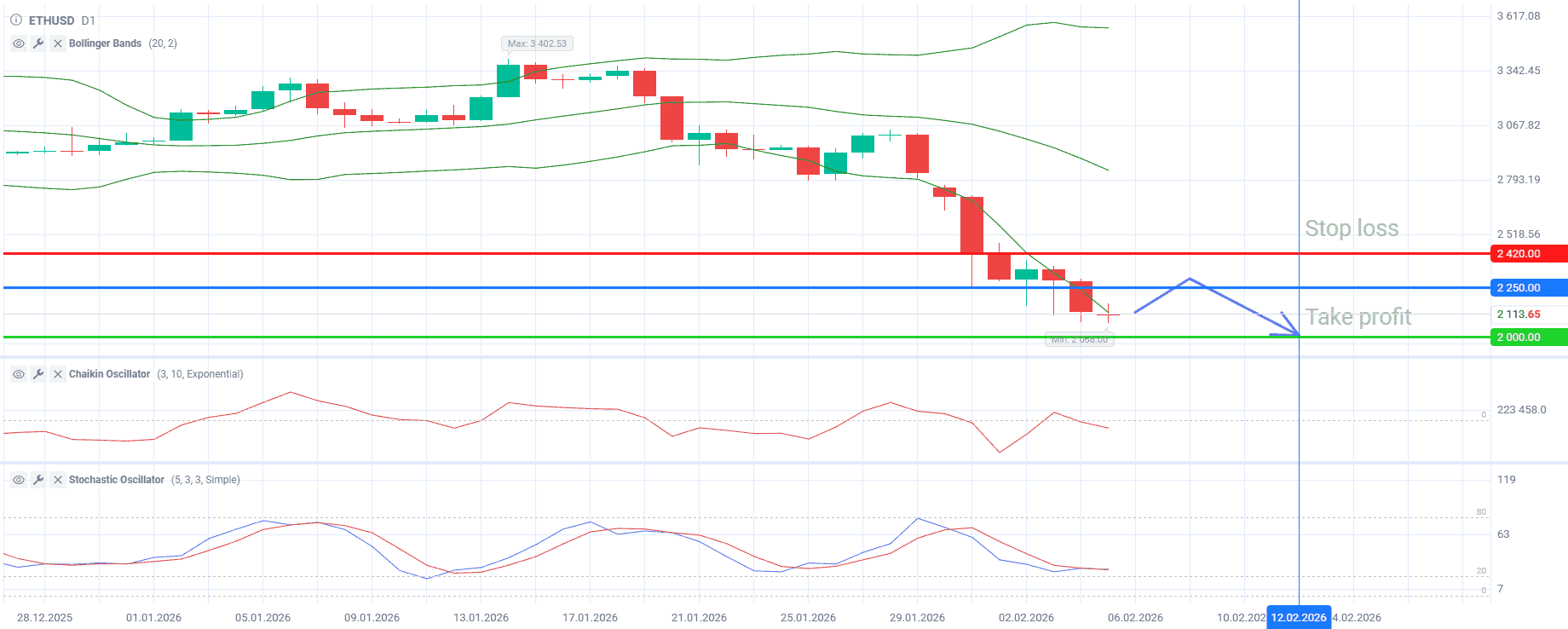

From a technical perspective, the ETHUSD pair is now showing signs of an uptrend. The Stochastic Oscillator on the daily timeframe has formed a bullish signal by turning up from the lower zone. Moreover, the growth of the On-Balance Volume (OBV) indicator since September 8 indicates that the advance is supported by real buyer volume. Breaking the $4,500 level could open the path to the $4,790 target.

Predictions for a Fed rate cut have already been factored into current prices. If a 25-basis-point reduction is confirmed and Jerome Powell maintains his rhetoric, further growth toward the August highs is likely to happen.

Take into account the recommendation given below:

Buy ETHUSD at the current price. Take profit: $4,790. Stop loss: $4,220.