Ethereum (ETHUSD) is in free fall, tumbling to $2,060 and edging perilously close to the psychological $2,000 threshold. After losing more than 24% in just seven days, the token has been dragged back to lows last visited in May 2025, caught in a sea of relentless selling with no clear anchor in sight.

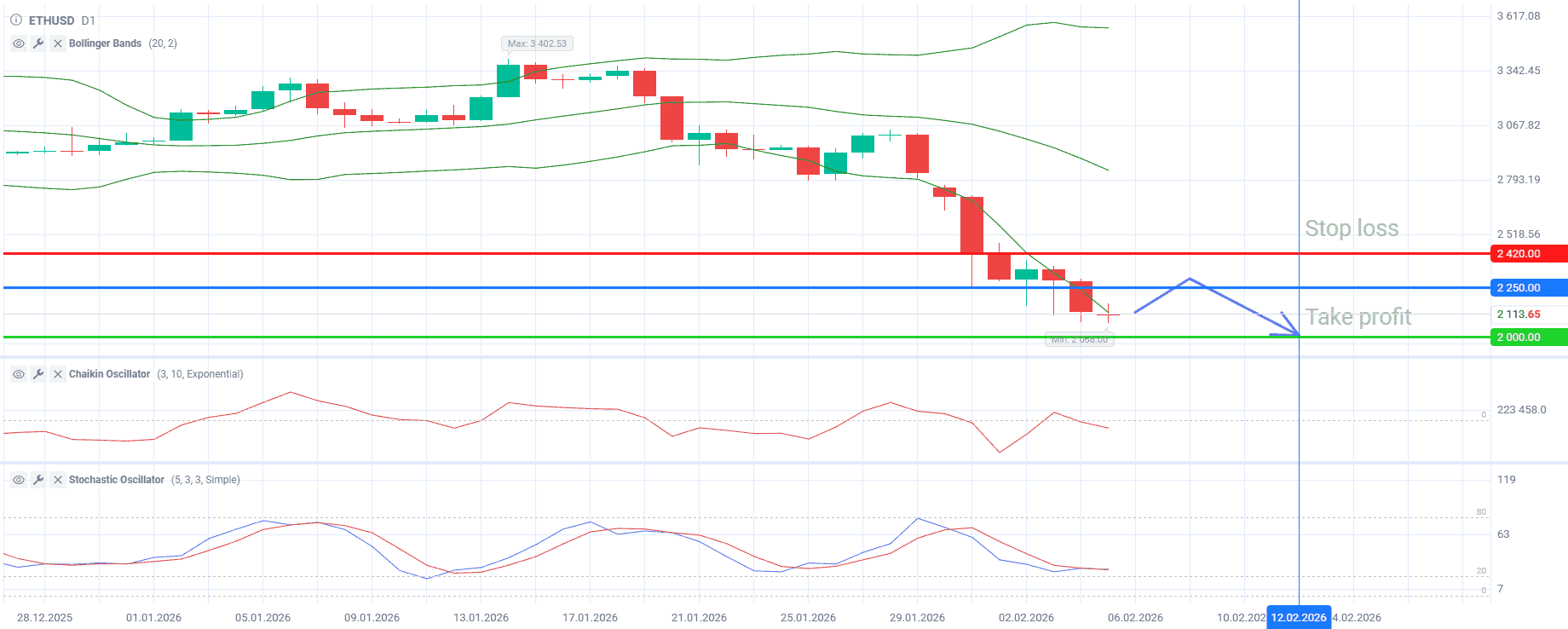

From a technical perspective, the daily chart tells a story of bearish dominance. Specifically, Bollinger Bands have dramatically expanded, with the price not just touching but crashing through the lower limit at $2,119. Such a breach often signals extreme oversold conditions that could ignite a temporary relief rally.

Likewise, the Chaikin Oscillator underscores this gloom, sinking deeper into the red. Its decisive plunge from positive territory on February 3 points to a clear shift in market sentiment—from accumulation to distribution—with bears taking the lead.

As for the Stochastic Indicator, it lingers near the oversold zone but has yet to fully commit, with both %K and %D frozen at 25 and moving in unison. This parallel descent shows no bullish divergence, suggesting the downtrend’s momentum remains unchecked. Still, the gravitational pull of the $2,000 support may attract enough bids to spark a short-term technical rebound if the slide pauses.

On the fundamental front, the outlook remains tense. Heavyweight holders like Trend Research continue to offload ETH, while BlockBeats analysts warn that a sustained break below $2,000 risks unleashing a cascade—potentially forcing the liquidation of over 615,000 ETH and exacerbating the sell-off.

A glimmer of stability, however, emerges from BitMine, which has been quietly accumulating tokens, securing more than 14,000 ETH over the past month. Therefore, a major accumulation zone is forming between $2,000–$2,100. For now, the scale is decisively tipped toward sellers, leaving Ethereum to navigate a narrow path.

Pay attention to the trading plan down below:

Sell ETHUSD on a rebound to the $2,220–$2,250 range. Place Take Profit at $2,000. Set Stop Loss at $2,420.

This forecast is relevant from February 5 till February 12, 2026.

Source: