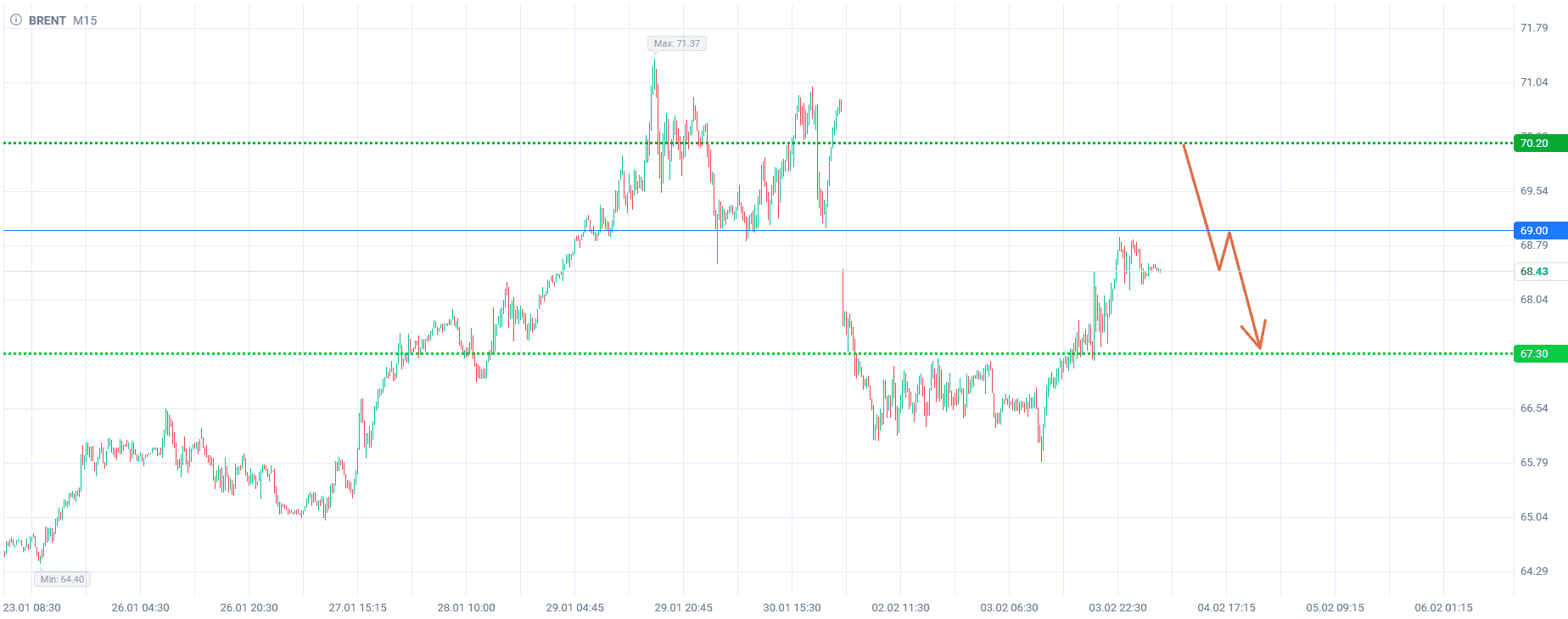

Brent crude is currently trapped in a technical vise, squeezed between the $70.2 ceiling and $67.3 floor. This compression zone sets the stage for a potentially volatile breakout, with several distinct scenarios in play:

1. Gap-fill rally. Prices could extend their recent hike to close this week’s opening gap and push toward the $70.2 resistance. However, buying here is strategically risky, as it goes against the powerful long-term downtrend.

2. Breakdown test. A sell-off might instead send fuel to the $67.3 support. Yet, this move is also fraught with danger, as the immediate technical momentum still favors an upward correction to close the gap in the short run.

3. Strategic sell (optimal play). Given the competing pressures, the most balanced risk/reward scenario is to initiate a short position from the $70.2 ceiling, once quotes advance that far. This strategy waits for the market to show its hand, offering an advantageous entry.

Still, the bigger picture for oil hasn’t changed at all:

Looming supply tsunami. The market is headed for a massive oversupply in 2026, with the International Energy Agency (IEA) projecting a surplus of 3.69–3.84 million barrels per day (bpd). This glut stems from a persistent structural mismatch: soaring inventories, particularly from non-OPEC+ nations, are far outstripping burgeoning appetite for fuel.

Imbalance by numbers. Global oil production is expected to swell by 2.5 million bpd in 2026, reaching a staggering 108.7 million. In stark contrast, demand is likely to rise by a mere 930,000 bpd.

Structural headwinds. The United States continues to ramp up its shale output, acting as a relentless swing operator. Combined with OPEC+’s managed production, this creates a substantial supply buffer that caps any sustained price rally.

The ultimate recommendation is to sell Brent crude when it rebounds to $70.2. Lock in profits at $67.3. Place Stop Loss at $71.5.

Calculate your open position so that a potential loss (protected by a Stop Loss order) is limited to 1% of your deposit. If your account balance does not allow entering a position of this size, it is better to skip the trade and wait for other market signals that meet low-risk criteria.