The S&P 500 Index (SPX) is now trying to regain its footing after a massive selloff driven by a series of disappointing earnings reports from tech giants. Buyers are trying to keep the price above key levels, supporting a consolidation phase.

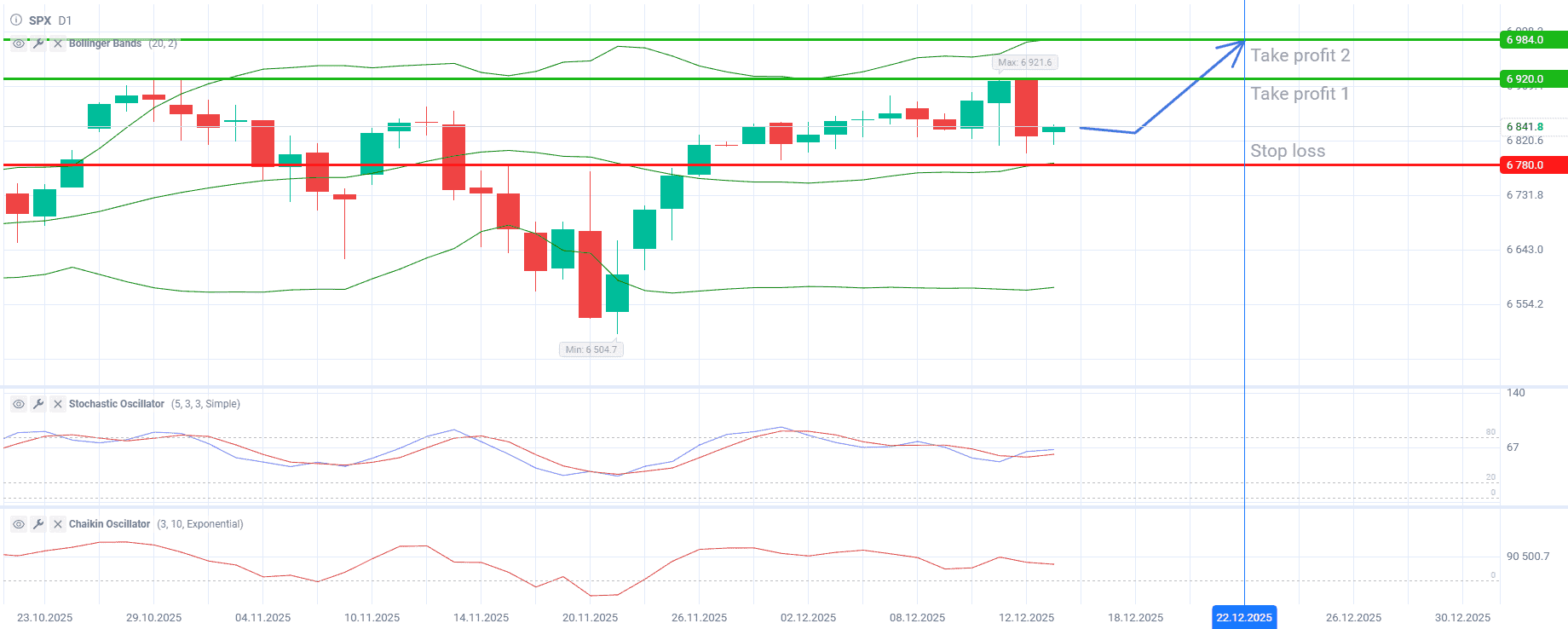

From a technical standpoint, the market retains potential for further gains, despite a setback for bulls. The price is sitting in the upper third of the Bollinger channel, near the middle line at $6,782.2, so the current trend is steady. The range width has remained unchanged since late November, confirming lower volatility and fewer sharp movements. The Chaikin Oscillator is still within overbought territory, suggesting bulls’ dominance. However, their strengths are slowly fading, with the indicator going down. Under these circumstances, the index may test the upper boundary of the Bollinger channel at $6,984.8.

This week’s fundamentals are linked to the release of key data—the US inflation and employment reports for November—which could sharply increase volatility. These readings should clarify the current economic conditions in the country after a prolonged government shutdown. Moreover, several Federal Reserve (Fed) officials, who did not support the recent interest rate cut, highlighted that future monetary policy will be highly susceptible to inflation risks. These factors, in tandem with the correction in the overheated artificial intelligence (AI) sector following weak forecasts from Oracle and Broadcom, are hanging over stocks like a dark cloud.

Nevertheless, in the medium term the situation is not hopeless, as positive drivers continue to underpin the S&P 500 Index. Expectations of substantial tax refunds in 2026 could support consumer spending, while ongoing capital investment in AI infrastructure remains a structural growth factor. Ultimately, when current macroeconomic uncertainty and consolidation are left behind, these drivers could help the index to resume the uptrend.

Consider the trading plan down below:

Buy SPX if the price holds above $6,800. Place Take profit 1 at $6,920, Take profit 2 at $6,984, and Stop loss at $6,780.

This forecast is valid from December 15 till December 22, 2025.