Прогнозы

06.02.2026

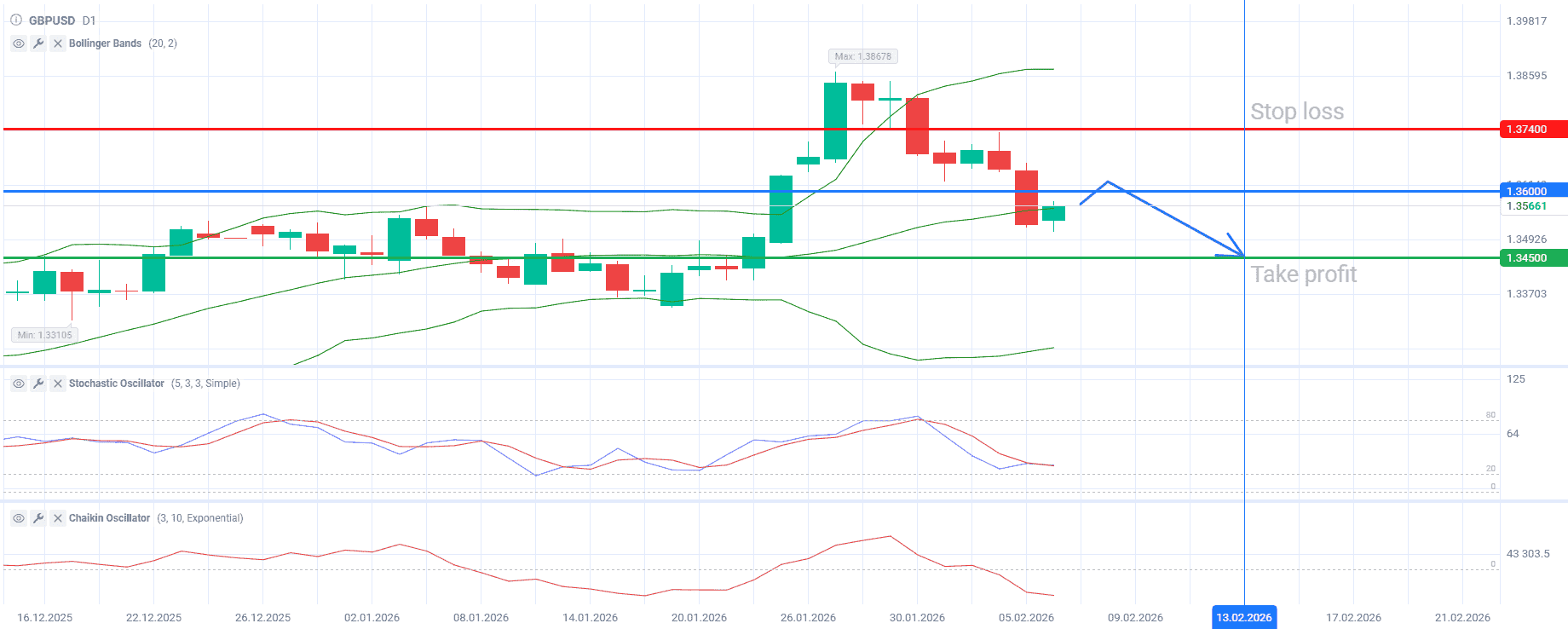

Пара GBPUSD показывает временное восстановление после решения Банка Англии по ставкам

06.02.2026

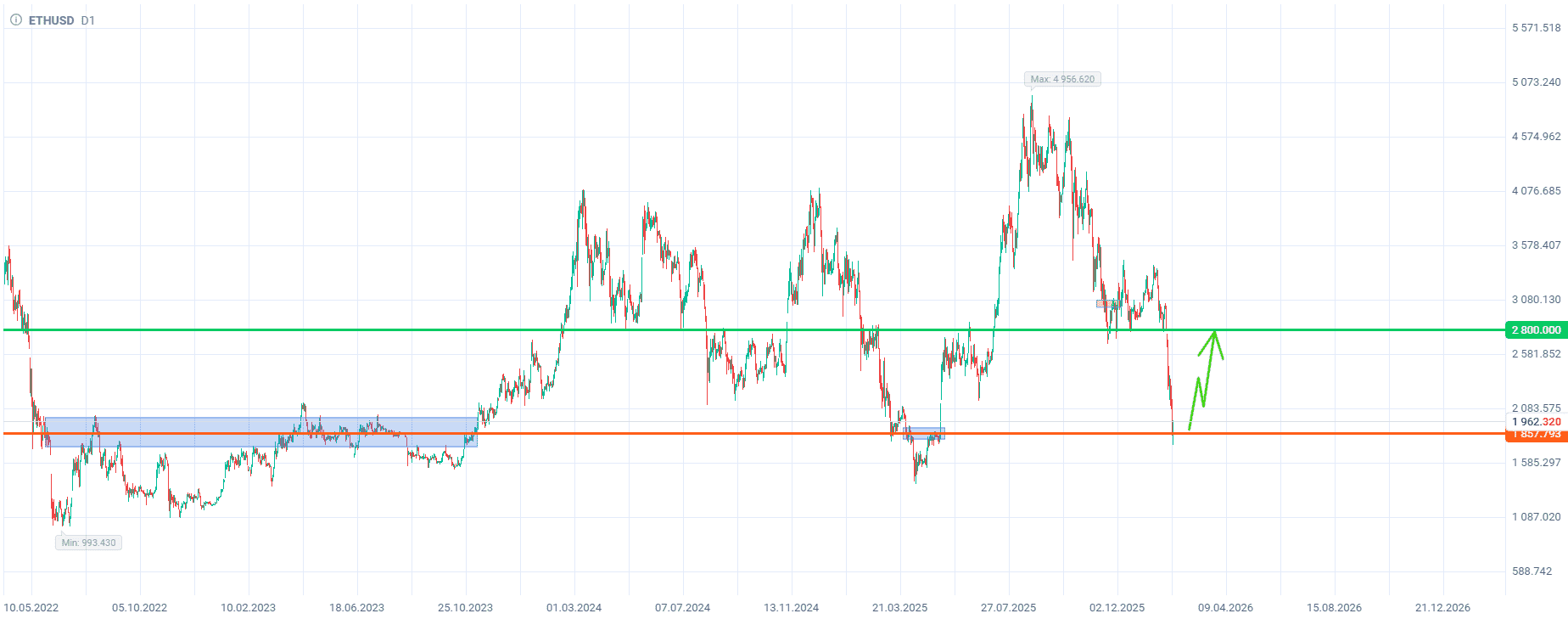

Покупка ETHUSD на глубокой коррекции

06.02.2026

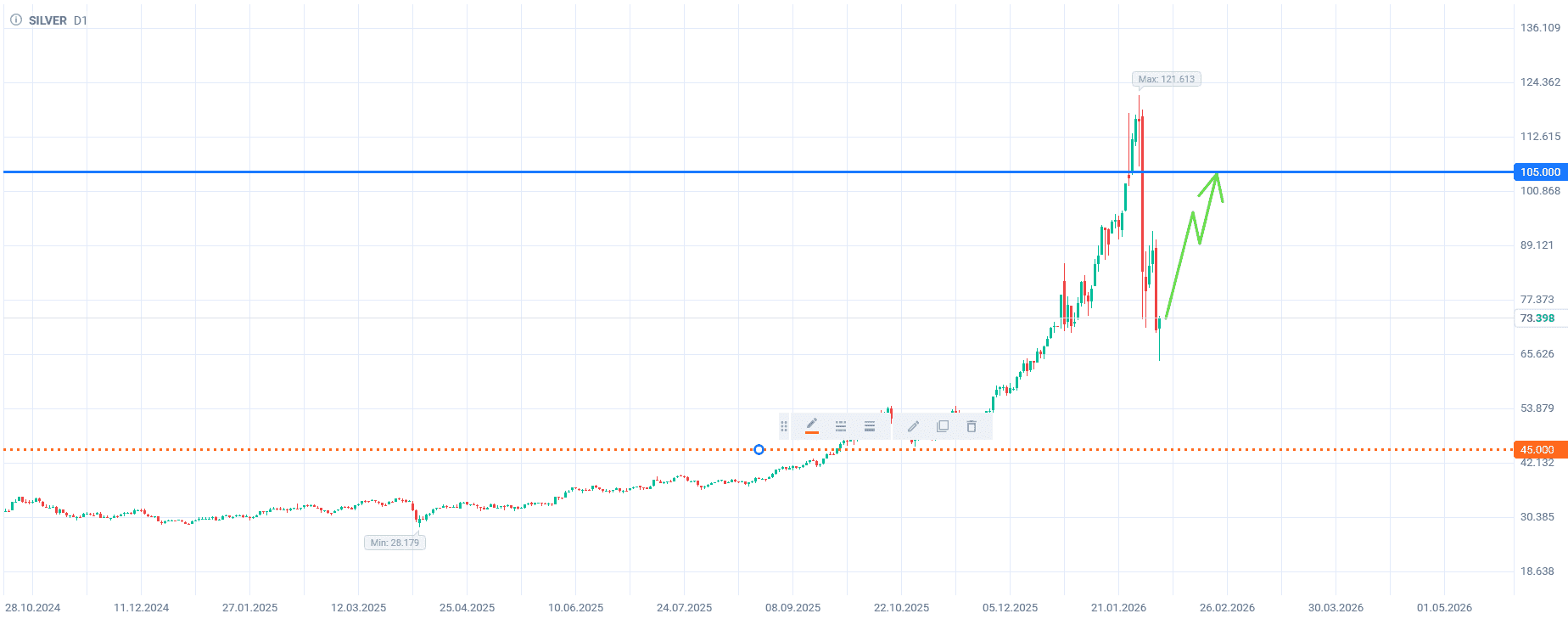

Среднесрочная покупка серебра

05.02.2026

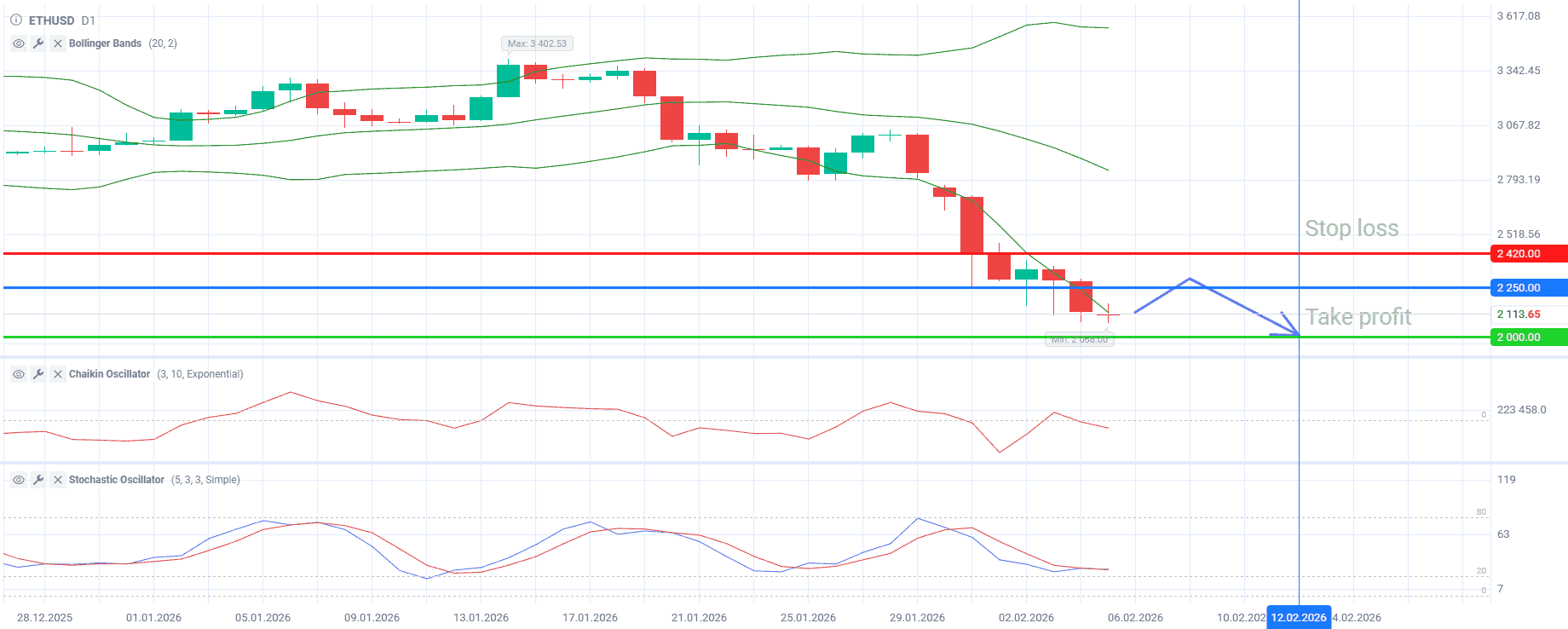

Продажа ETHUSD при отскоке к сопротивлению 2250

05.02.2026

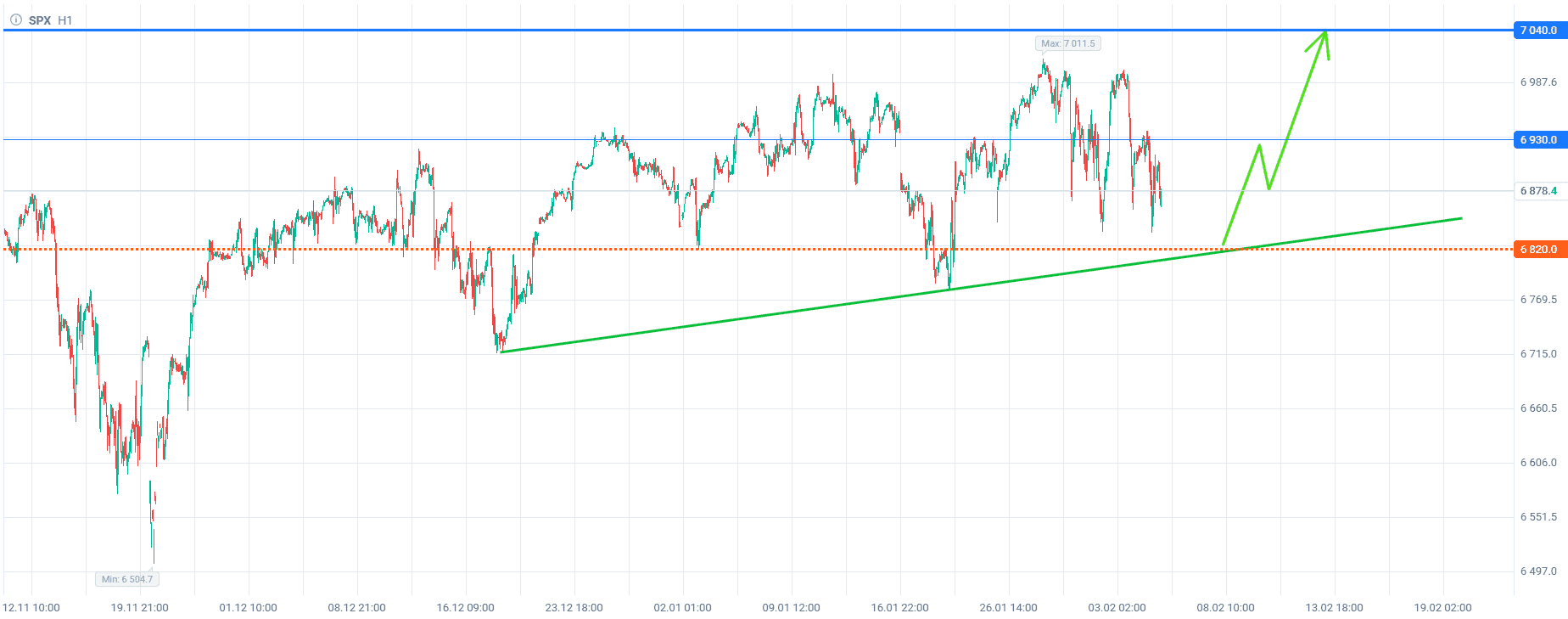

Покупка SPX от уровня 6820

05.02.2026

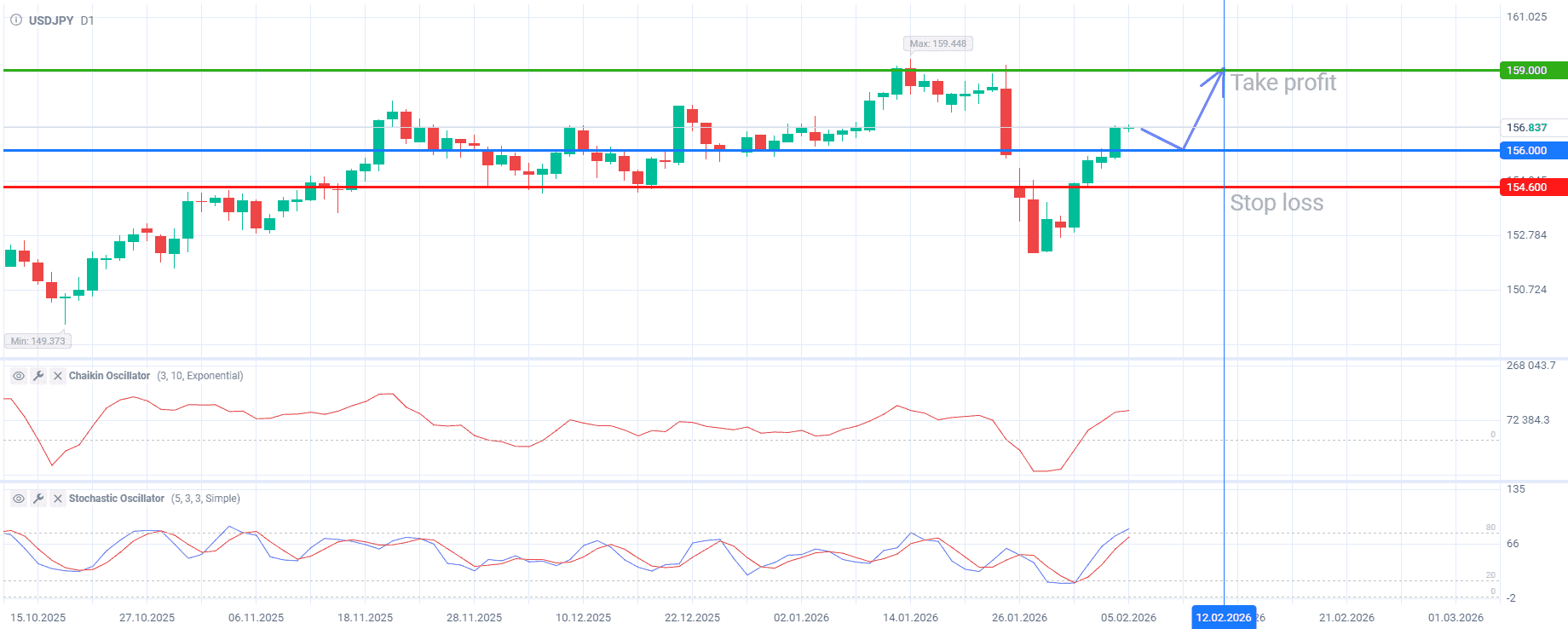

Покупка USDJPY в ожидании победы правящей коалиции на выборах

04.02.2026

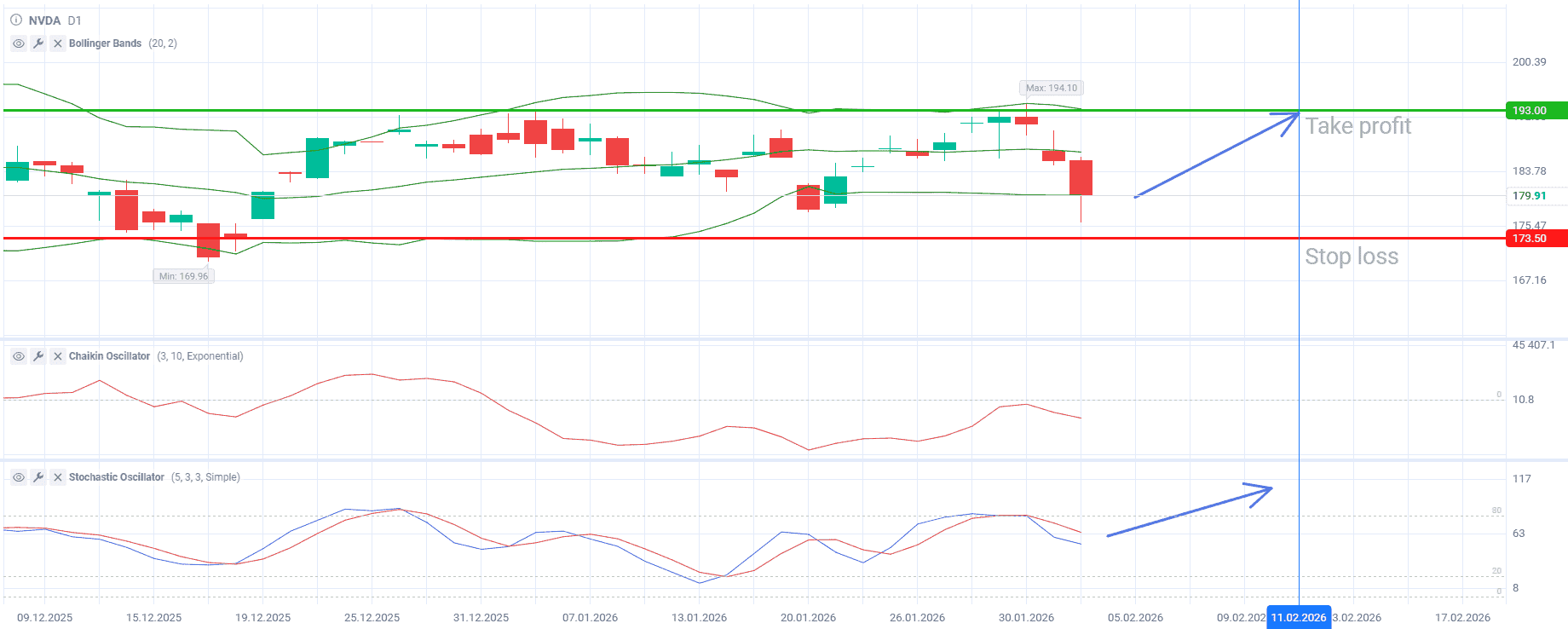

Акций NVIDIA подошли к важной зоне для возможного разворота

04.02.2026

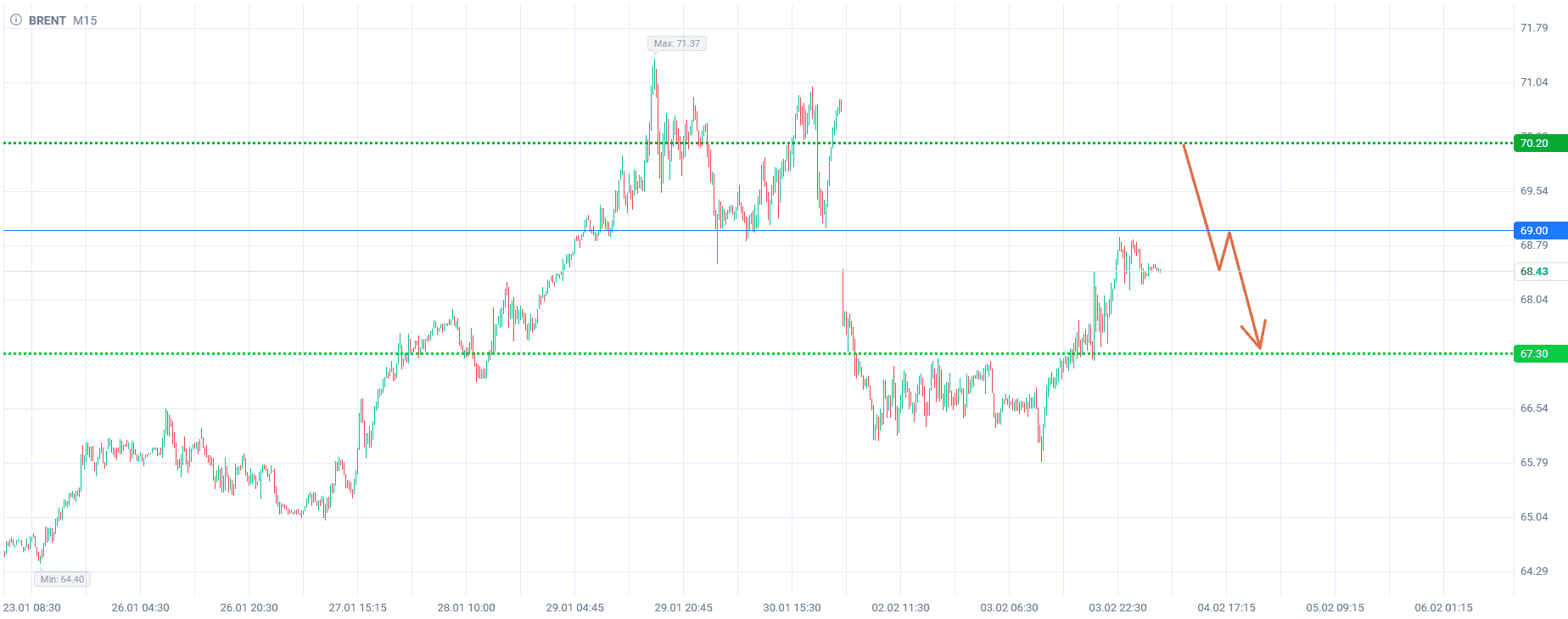

Продажа нефти Brent от уровня 70,2

График Online

Используйте главный инструмент трейдеров – технический анализ на графике финансового инструмента.